New York, USA, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Sickle Cell Disease Market is Predicted to Exhibit Remarkable Growth at a CAGR of 22.1% During the Forecast Period (2025–2034) Across 6MM, Owing to the Increasing Prevalence, Awareness, and Advancements in Gene Therapies | DelveInsight

The sickle cell disease market is anticipated to grow by 2034, driven by advances in disease mechanisms that have yielded new diagnostic and therapeutic approaches, opening the way to more drug development. In addition, the increasing prevalence and the launch of emerging therapies, such as inclacumab (Pfizer), etavopivat (Novo Nordisk), mitapivat (Agios Pharmaceuticals), osivelotor (Pfizer), and others, will also contribute to the growing market size during the forecast period.

DelveInsight’s Sickle Cell Disease Market Insights report includes a comprehensive understanding of current treatment practices, emerging SCD drugs, market share of individual therapies, and current and forecasted SCD market size from 2020 to 2034, segmented into leading markets (the US, EU4, and the UK).

Sickle Cell Disease Market Summary

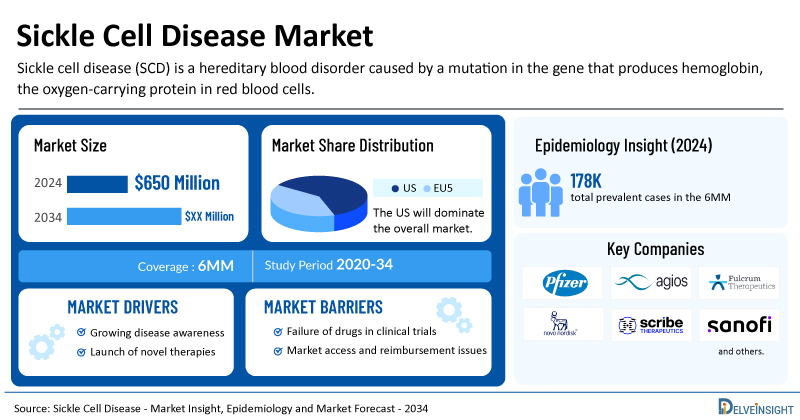

- The market size for sickle cell disease was found to be USD 650 million in the 6MM in 2024.

- The United States accounted for the largest sickle cell disease treatment market size, approximately 87% of the total market size in the 7MM in 2024, compared to other major markets, including the EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom.

- All lots of OXBRYTA for the treatment of SCD in all markets were withdrawn in September 2024.

- The total prevalent cases of SCD in the 6MM were nearly 178,500. These cases are expected to increase by 2034.

- Key SCD companies, including Pfizer, Agios Pharmaceuticals, Fulcrum Therapeutics, Novo Nordisk, Scribe Therapeutics, Sanofi, and others, are actively working on innovative SCD drugs.

- Some of the key SCD therapies in clinical trials include Osivelotor (GBT-601), Mitapivat, Pociredir, Inclacumab, Etavopivat, CRISPR by Design, and others. These novel SCD therapies are anticipated to enter the SCD market in the forecast period and are expected to change the market.

- In comparison to all available therapies, CASGEVY and LYFGENIA are expected to become the market leader, having a major influence on the SCD market of the 6MM by 2034.

Discover which SCD medications are expected to grab the market share @ Sickle Cell Disease Market Report

Key Factors Driving the Growth of the SCD Market

Rising SCD Prevalence

According to DelveInsight’s assessment, in 2024, the total prevalent cases of sickle cell disease (SCD) in the 6MM were nearly 178.5K. These cases are anticipated to increase by 2034, with the majority occurring in individuals aged 18–44 years, followed by those aged 45–64 years, and fewer in younger (0–17 years) and older (65+ years) populations.

Current Standard of Care

The present treatment landscape for SCD includes NSAIDs, blood transfusions, chelating agents, nutritional supplements, and broad-spectrum antibiotics to manage complications. Established disease-modifying therapies include DROXIA (hydroxyurea), ENDARI (L-glutamine oral powder), and ADAKVEO (crizanlizumab-tmca). However, in September 2024, all lots of OXBRYTA were withdrawn across all markets, creating a treatment gap in the standard of care.

Launch of Emerging SCD Drugs

The SCD clinical trial landscape appears to be growing, with key players such as Novo Nordisk (etavopivat; NDec), Pfizer (osivelotor; inclacumab), Agios Pharmaceuticals (mitapivat), Fulcrum Therapeutics (pociredir), and others developing their assets in both early and late phases.

Sickle Cell Disease Market Analysis

Although sickle cell disease is widespread in the United States, many patients still receive inadequate care, particularly when treated by non-specialists. This highlights gaps within the healthcare system, leading to poor symptom control.

Management of SCD involves both drug-based and supportive therapies. Approved pharmacologic treatments include hydroxyurea, ENDARI (L-glutamine), ADAKVEO (crizanlizumab), CASGEVY (exagamglogene autotemcel), and LYFGENIA (lovotibeglogene autotemcel). Pain is commonly managed with opioids, NSAIDs, acetaminophen, and corticosteroids. Non-drug interventions, such as cognitive behavioral therapy, relaxation methods, biofeedback, and acupuncture, also play a supportive role.

Hydroxyurea remains the standard first-line option, while newer agents are being used to enhance symptom control. Therapies like ADAKVEO show strong adherence due to favorable dosing schedules and their ability to reduce vaso-occlusive crises.

Multiple next-generation treatments are progressing through the pipeline. Notable developers include Pfizer (inclacumab, GBT-601), Novo Nordisk (etavopivat), Bluebird Bio (lovo-cel), and Agios Pharmaceuticals (mitapivat). These emerging options aim to fill critical gaps by offering curative potential, improved safety, and greater convenience. With increasing disease burden and expected regulatory approvals, the SCD landscape is set for expansion and remains an attractive area for future investment.

Learn more about the SCD treatment options @ Sickle Cell Disease Treatment Market

Sickle Cell Disease Competitive Landscape

SCD clinical trial landscape possesses some drugs in mid- and late-stage development to be approved in the near future. The expected launch of therapies such as inclacumab (Pfizer), etavopivat (Novo Nordisk), mitapivat (Agios Pharmaceuticals), osivelotor (Pfizer), and others are anticipated to create a positive impact on the market.

Agios Pharmaceuticals’ Mitapivat is an innovative, first-in-class oral small molecule that acts as an allosteric activator of the pyruvate kinase enzyme. It has demonstrated the ability to markedly enhance the activity of both wild-type and various mutant forms of erythrocyte pyruvate kinase (PKR), leading to increased ATP generation and reduced concentrations of 2,3-diphosphoglycerate.

Pfizer’s Osivelotor is an advanced inhibitor of sickle hemoglobin (HbS) polymerization, designed with improved pharmacokinetic characteristics that help maintain hemoglobin in its oxygenated state and prevent polymer formation. The therapy may enable higher hemoglobin levels and greater target engagement at lower doses, potentially decreasing treatment burden and improving outcomes for individuals with sickle cell disease (SCD). In 2022, it received Orphan Drug Designation (ODD) and Rare Pediatric Disease Designation (RPDD) from the FDA.

CRISPR by Design refers to Scribe’s data-driven strategy for developing and refining its CRISPR-based technologies, including its X-Editing (XE) platform, to advance a new generation of transformative genetic therapies.

Sanofi and Scribe Therapeutics are working under an expanded collaboration initiated in September 2022, which includes an exclusive licensing agreement for CasXEditor (XE) genome-editing technology and associated guide RNAs across multiple targets, including sickle cell disease and other genetic disorders.

The anticipated launch of these emerging SCD therapies are poised to transform the SCD market landscape in the coming years. As these cutting-edge SCD therapies continue to mature and gain regulatory approval, they are expected to reshape the SCD market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about new treatment for SCD, visit @ Sickle Cell Disease Medication

Recent Developments in the SCD Market

- In November 2025, Fulcrum Therapeutics announced that new data from the Phase Ib PIONEER trial of pociredir in SCD will be presented at ASH 2025.

- In October 2025, Fulcrum Therapeutics announced that data disclosure of the Phase Ib PIONEER trial Cohort 4 (20 mg) is planned by year's end 2025.

- In August 2025, Pfizer announced results from the Phase III THRIVE-131 study evaluating inclacumab, which did not meet its primary endpoint of significant reduction in the rate of vaso-occlusive crises (VOCs) in participants receiving inclacumab versus placebo every 12 weeks over 48 weeks.

- In March 2025, due to a lack of finding a commercial partner, Editas Medicine discontinued EDIT-301.

- In January 2025, Scribe Therapeutics announced the achievement of a milestone for one of the targets in its research collaboration with Sanofi to develop in vivo CRISPR-based therapeutics.

- Topline results from the RISE UP Phase III trial of mitapivat in SCD are expected by the end of the year, potentially supporting a US commercial launch in 2026. Agios Pharmaceuticals also announced a poster presentation of mitapivat at ASH 2025.

What is Sickle Cell Disease?

Sickle cell disease (SCD) is a hereditary blood disorder caused by a mutation in the gene that produces hemoglobin, the oxygen-carrying protein in red blood cells. This mutation leads to the formation of abnormal “sickle-shaped” red blood cells that are stiff, sticky, and prone to clumping together. As a result, these misshapen cells can block blood flow in small vessels, leading to painful episodes, organ damage, an increased risk of infections, and chronic anemia. SCD is a lifelong condition that primarily affects individuals of African, Middle Eastern, and South Asian descent and requires ongoing medical care to manage symptoms and prevent complications.

Sickle Cell Disease Epidemiology Segmentation

The SCD epidemiology section provides insights into the historical and current SCD patient pool and forecasted trends for the leading markets. As per the estimates, the US accounted for approximately 73% of the total diagnosed prevalent cases of SCD in the 6MM.

The SCD market report proffers epidemiological analysis for the study period 2020–2034 in the leading markets segmented into:

- Total Diagnosed Cases of SCD

- Age-specific Diagnosed Cases of SCD

- Type-specific Diagnosed Cases of SCD

Download the report to understand SCD management @ Sickle Cell Disease Treatment Options

| Sickle Cell Disease Market Report Metrics | Details |

| Study Period | 2020–2034 |

| Sickle Cell Disease Market Report Coverage | 6MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom] |

| Sickle Cell Disease Market CAGR | 22.1% |

| Sickle Cell Disease Market Size in 2024 | USD 650 Million |

| Key Sickle Cell Disease Companies | Pfizer, Agios Pharmaceuticals, Fulcrum Therapeutics, Novo Nordisk, Scribe Therapeutics, Sanofi, Emmaus Life Sciences, Vertex Pharmaceuticals, CRISPR Therapeutics, Bluebird Bio, and others |

| Key Sickle Cell Disease Therapies | Osivelotor (GBT-601), Mitapivat, Pociredir, Inclacumab, Etavopivat, CRISPR by Design, ENDARI, ADAKVEO, CASGEVY, LYFGENIA, and others |

Scope of the Sickle Cell Disease Market Report

- Sickle Cell Disease Therapeutic Assessment: Sickle Cell Disease current marketed and emerging therapies

- Sickle Cell Disease Market Dynamics: Conjoint Analysis of Emerging Sickle Cell Disease Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Sickle Cell Disease Market Unmet Needs, KOL’s views, Analyst’s views, Sickle Cell Disease Market Access and Reimbursement

Discover more about SCD drugs in development @ Sickle Cell Disease Clinical Trials

Table of Contents

| 1 | Sickle Cell Disease Market Key Insights |

| 2 | Sickle Cell Disease Market Report Introduction |

| 3 | Executive Summary |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology |

| 6 | Sickle Cell Disease (SCD) Market Overview at a Glance |

| 6.1 | Clinical Landscape Analysis (by Phase, RoA, and Molecule Type) |

| 6.2 | Market Share (%) Distribution of SCD by Therapies in 2024 |

| 6.3 | Market Share (%) Distribution of SCD by Therapies in 2034 |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Classification of Sickle Cell Disease |

| 7.3 | Sickle Cell Disease Causes |

| 7.4 | Associated Risk Factors |

| 7.5 | Sickle Cell Disease Complications |

| 7.6 | Sickle Cell Disease Symptoms |

| 7.7 | Sickle Cell Disease Pathophysiology |

| 7.8 | Sickle Cell Disease Diagnosis |

| 7.9 | Treatment and Management of Sickle Cell Disease |

| 7.10 | Sickle Cell Disease Treatment Algorithm |

| 7.11 | Sickle Cell Disease Treatment Guidelines |

| 8 | Epidemiology and Patient Population |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationale |

| 8.3 | Total Diagnosed Prevalent Cases of SCD in the 6MM |

| 8.4 | The United States |

| 8.4.1 | Total Diagnosed Cases of SCD in the United States |

| 8.4.2 | Age-specific Diagnosed Cases of SCD in the United States |

| 8.4.3 | Type-specific Diagnosed Cases of SCD in the United States |

| 8.5 | EU4 and the UK |

| 9 | Sickle Cell Disease Patient Journey |

| 10 | Marketed Sickle Cell Disease Therapies |

| 10.1 | Key Cross Competition |

| 10.2 | ENDARI (L-glutamine): Emmaus Life Sciences |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Developmental Activities |

| 10.2.4 | Summary of Pivotal Trials |

| 10.2.5 | Clinical Development |

| 10.2.5.1 | Clinical Trials Information |

| 10.2.6 | Safety and Efficacy |

| 10.2.7 | Analyst Views |

| 10.3 | ADAKVEO (crizanlizumab): Novartis Pharmaceuticals |

| 10.4 | CASGEVY: Vertex Pharmaceuticals/CRISPR Therapeutics |

| 10.5 | LYFGENIA (Lovo-cel): Bluebird Bio |

| List to be continued in the report… | |

| 11 | Emerging Sickle Cell Disease Therapies |

| 11.1 | Key Cross Competition |

| 11.2 | Osivelotor (GBT-601): Pfizer |

| 11.2.1 | Product Description |

| 11.2.2 | Other Developmental Activities |

| 11.2.3 | Clinical Developmental |

| 11.2.3.1 | Clinical Trial Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analyst Views |

| 11.3 | Mitapivat: Agios Pharmaceuticals |

| 11.4 | Pociredir: Fulcrum Therapeutics |

| 11.5 | Inclacumab: Pfizer |

| 11.6 | Etavopivat: Novo Nordisk |

| 11.7 | CRISPR by Design: Scribe Therapeutics and Sanofi |

| List to be continued in the report | |

| 12 | Sickle Cell Disease Market – 6MM Analysis |

| 12.1 | Key Findings |

| 12.2 | Sickle Cell Disease Market Outlook |

| 12.3 | Conjoint Analysis |

| 12.4 | Key Sickle Cell Disease Market Forecast Assumptions |

| 12.5 | Total Market Size of SCD in the 6MM |

| 12.6 | Market Size of SCD by Therapies in the 6MM |

| 12.7 | The United States Sickle Cell Disease Market Size |

| 12.7.1 | Total Market Size of SCD in the United States |

| 12.7.2 | Market Size of SCD by Therapies in the United States |

| 12.8 | EU4 and the UK Sickle Cell Disease Market Size |

| 13 | KOL Views on Sickle Cell Disease |

| 14 | Sickle Cell Disease Market Unmet Needs |

| 15 | Sickle Cell Disease Market SWOT Analysis |

| 16 | Sickle Cell Disease Market Access and Reimbursement |

| 16.1 | The United States |

| 16.1.1 | Center for Medicare & Medicaid Services (CMS) |

| 16.2 | EU4 and the UK |

| 17 | Sickle Cell Disease Market Report Methodology |

| 18 | Bibliography |

Related Reports

Sickle Cell Disease Clinical Trial Analysis

Sickle Cell Disease Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key SCD companies, including CRISPR therapeutics, Bluebird Bio, Pfizer, Novo Nordisk, Agios Pharmaceuticals, Alexion Pharmaceuticals, Takeda, Prolong Pharmaceuticals, Roche, Beam Therapeutics, Editas Medicine, Sangamo Therapeutics, Bellicum Pharmaceuticals, Invenux, EpiDestiny, Hillhurst Biopharmaceuticals, CSL Behring, Fulcrum Therapeutics, Sana Biotechnology, among others.

Hemophilia Market Insights, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key hemophilia companies, including Centessa Pharmaceuticals, Alnylam Pharmaceuticals, ASC Therapeutics, Spark Therapeutics, Freeline Therapeutics, BioMarin Pharmaceutical, Staidson Beijing BioPharmaceuticals, Pfizer, Sangamo Therapeutics, Amunix, Bioverativ, Novo Nordisk, among others.

Hemophilia A Market Insights, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key hemophilia A companies, including Novo Nordisk, Ultragenyx Pharmaceutical, Sangamo Therapeutics, ASC Therapeutics, Roche, Chugai, Sanofi, Alnylam Pharmaceuticals, Pfizer, Genentech, BioMarin Pharmaceutical, HEMA Biologics, LFB Pharmaceuticals, Octapharma, CSL Behring, Octapharma, Bayer, Takeda, among others.

Hemophilia B Market Insights, Epidemiology, and Market Forecast – 2032 report delivers an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key hemophilia B companies, including UniQure Biopharma B.V., CSL Behring, Pfizer, Spark Therapeutics, Genzyme, a Sanofi Company, Alnylam Pharmaceuticals, Novo Nordisk, UniQure Biopharma B.V., ApcinteX Ltd, Freeline Therapeutics, Sangamo Therapeutics, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com